While the terms and conditions, on most occasions, are never read, it is crucial for a business owner to understand the nitty gritty of the SUN. For starters, since the number is generated automatically by the system, therefore, one cannot amend or customize it. Additionally, each business entity gets its own SUN number. What this means is that a business person with more than one business will have to get a SUN number for each entity.

Upon selecting a preferred SUN number, it will be reserved for thirty minutes while they process the payment of the fees. If the fee is not paid within this period, the reservation will be withdrawn and the number made available to other applicants. This will also apply in case the number is not issued within the thirty minutes- for any reason whatsoever, including the failure of the systems. If the number is still available when one is ready to pay or no other obstacles are on the way, you can always pick it.

The number is issued upon successful payment of the SUN fee, which is nonrefundable. Once the number is allocated to a business entity, it cannot be transferred to another business entity by an individual. Neither can it be exchanged with any other SUN, whether it has been issued or not.

Last but not least, the ACRA has the right to withdraw a SUN that is reserved or issued in case the same number has been issued to a different entity for whatever reason. In case such an event occurs, the business owner of the first entity can select a new number.

These terms and conditions might vary or be changed in the future. It is highly advisable for an applicant to go through the terms and conditions bit before registering or converting their businesses to get the SUN.

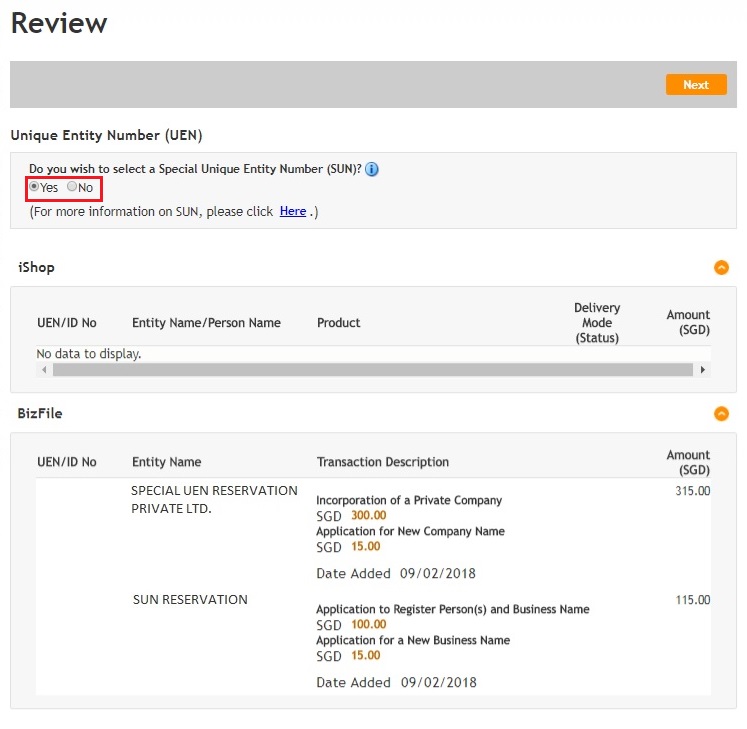

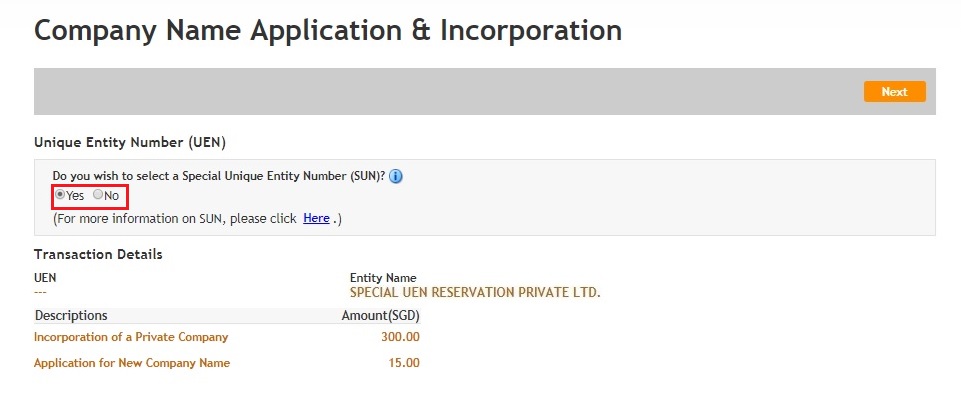

The BizFile page also has a link to any available SUNs at any particular moment. You can click here first to see the available SUNs and choose one suits you.

The BizFile page also has a link to any available SUNs at any particular moment. You can click here first to see the available SUNs and choose one suits you.