Effortless and punctual tax filing (Form C/C-S) facilitated by Timcole’s committed accountants.

Form C/C-S filing is obligatory

for Singapore companies.

- In Singapore, every company must electronically submit their Corporate Income Tax Returns through either Form C or Form C-S.

- The filing deadline is fixed on November 30 with no extensions granted.

- These tax returns pertain to income earned in the preceding financial year, known as the Year of Assessment (YA).

- Form C-S is intended for companies with annual revenue of $5 million or less, taxed at the standard corporate rate of 17%, and not seeking benefits like loss carry-back relief, group relief, investment allowance, or foreign tax credit. Other companies are required to use Form C and include their financial statements.

Summarises the various types of Corporate Income Tax Return in Singapore.

| Description | Form C-S | Form C-S (Lite) | Form C |

| Annual Revenue for Qualifying Companies | $5 million or below | $200,000 or below | Any company can submit |

| Submission of Financial Statements & Tax Computation | Not Required | Required | |

| Other Qualifying Conditions |

|

||

Fee Guideline for Tax Filing Services

The following table provides you with our fee guideline for Corporate Income Tax Filing Services. For a more accurate estimate, kindly contact us for further discussion.

| Apply Waiver of Form C for Dormant Companies | $100 |

| Simplified Tax Computation + Form C/S Filling | $400 |

| Comprehensive Tax Report + Form C/S Filling | $900 |

| Simplified Tax Computation + Form C Filling | $600 |

| Comprehensive Tax Report + Form C Filling | $1200 |

| Tax Filing for Sole Proprietorship / Partnership | $200 – $300 |

| Other Ad-hoc Tax Services (e.g. Personal Income Tax Submission) |

$100 – $200 |

Add-on Options

| Tax Returns with Capital Allowance or S14Q R&R Claims | Add $50 – $150 |

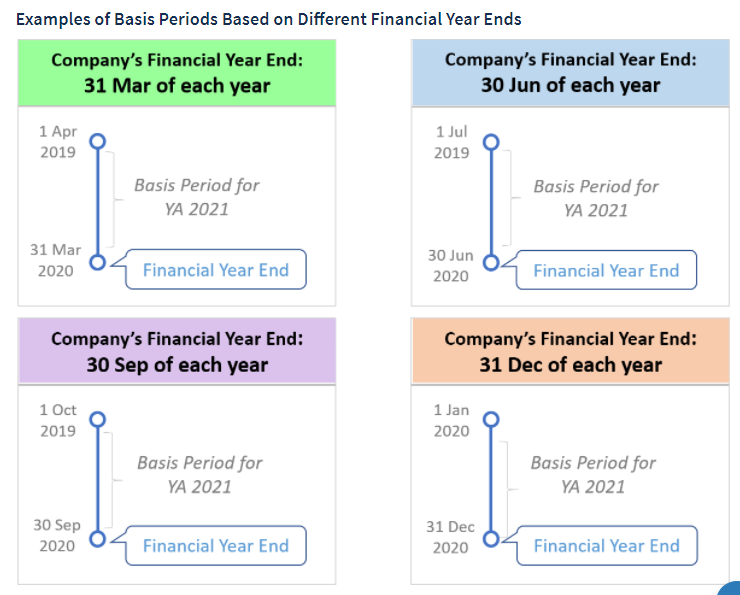

Basis Period and Year of Assessment (YA)

Your company is taxed on the income earned in the preceding financial year.

This means that income earned in the financial year 2020 will be taxed in 2021. In tax terms, 2021 is the Year of Assessment (YA), as it is the year in which your company’s income is assessed to tax.

To assess the amount of tax, IRAS looks at the income, expenses, etc. during the financial year. This financial year is known as the ‘basis period’.

The basis period is generally a 12-month period preceding the YA.

Consequences for late or non-filing of tax returns

Failure to file your Form C-S/ C together with financial statements and tax computation by the due date is an offence.

IRAS may take the following enforcement actions if you fail to file by the due date:

- Issue an estimated Notice of Assessment. You must pay the estimated tax within 1 month

- Offer to compound the offence

- Issue a Section 65B(3) notice to your company director to submit the required information in the Form C-S/ C to IRAS

- Summon the company or persons responsible for running of the company (including the directors) to Court

FAQs

My company qualifies to file Form C-S (Lite). Can I choose to file Form C-S or Form C instead?

Yes. Companies that qualify to file Form C-S (Lite) can still choose to file Form C-S or Form C.

What is the Corporate Income Tax Rate?

Your company is taxed at a flat rate of 17% of its chargeable income. This applies to both local and foreign companies.

What is the definition of Chargeable Income?

Chargeable income refers to your company’s taxable income (after deducting tax-allowable expenses) for a Year of Assessment (YA).

How are the qualifying conditions different for Form C-S and Form C-S (Lite)?

The only difference is in the annual revenue condition. The annual revenue condition is $5 million or below for Form C-S and $200,000 or below for Form C-S (Lite).

What are the differences between Form C-S and Form C-S (Lite)?

Form C-S (Lite) is a simplified version of Form C-S for smaller companies. For companies with straight-forward tax matters, Form C-S (Lite) requires only 6 essential fields to be completed, compared to 18 fields in Form C-S.

Can I request for an extension to file my company overdue tax return?

For current Year of Assessment

A request for extension to file may be made online via our Request Penalty Waiver/ Extension of Time to File digital service at mytax.iras.gov.sg.

However, if a summons to attend Court has been issued, filing extensions are not allowed. If you require an extension to file, your company representative/the director must attend Court on the Court date to appeal for an extension.

For previous Year(s) of Assessment

No filing extensions will be granted as the returns are long overdue

Let Timcole Help You with Corporate Tax Filing Today!

All companies need to submit their tax returns in the relevant Year of Assessment to IRAS. With the assistance of our tax professionals, this goal is a lot easier to attain. We will help you plan effective tax strategies and to do proper tax planning, so that you can be paying as little tax as possible, without breaking the law.

Our corporate tax services assist you in the:

- Preparation of Tax Computation and tax schedules

- Filing of Estimated Chargeable Income (ECI) 3 months after your Financial Year End

- Filing of Corporate Tax Return in Form-C or Form C-S

- Liaison with IRAS to answer queries relating to your tax matters

Please call us now for a discussion on how we can help you to register your company for GST and to assist you in doing proper corporate income tax filing.