Ever since the announcement to increase the Goods and Services Tax (GST) by two percentage points, from 7 per cent to 9 per cent, in 2018, there have been a lot of speculations in terms of when and how will this impact us.

But the wait is over. It was announced in Budget 2022 that the increase will be implemented in two stages, one percentage point each in 2023 and 2024.

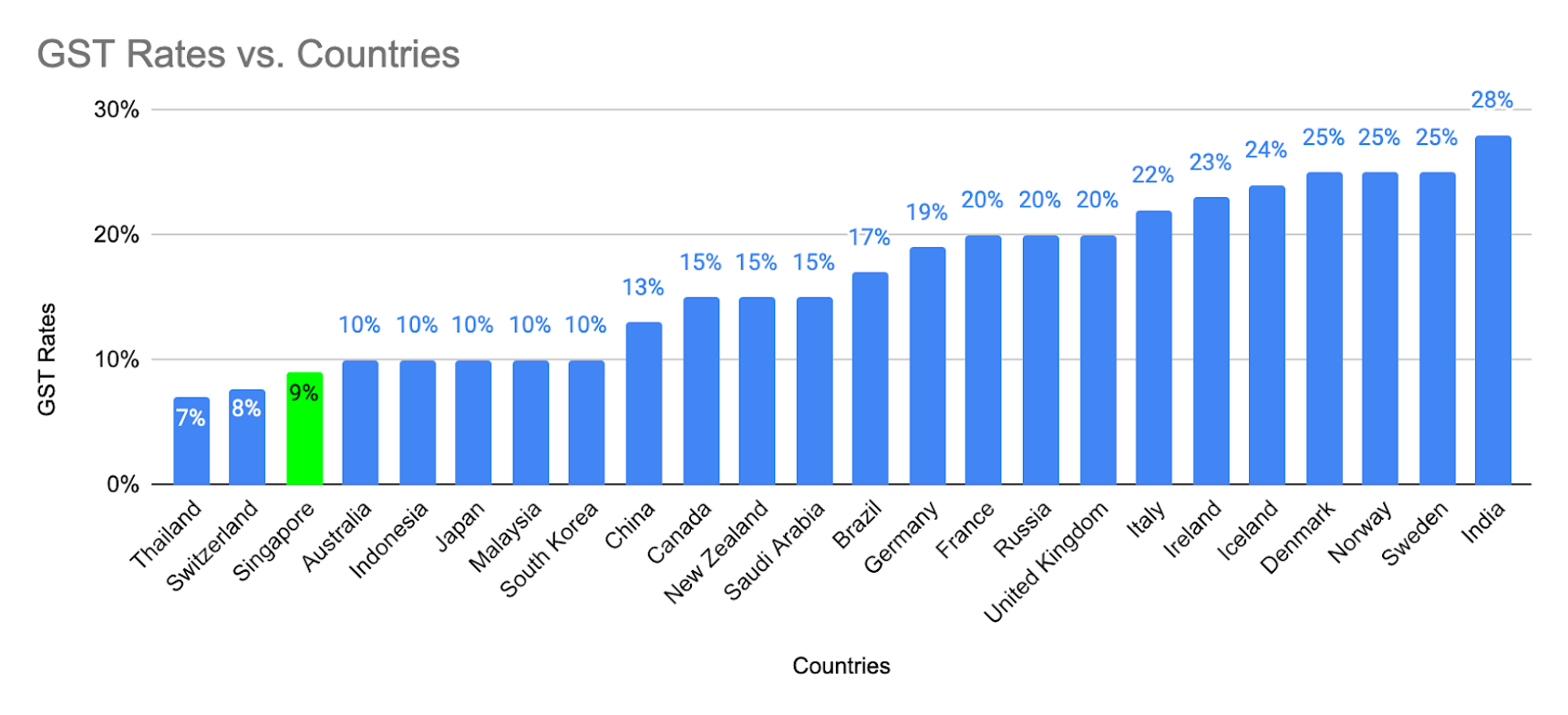

While any tax increase can raise many concerns amongst businesses and individuals, we need to understand the rationale behind it. Singapore already has one of the lowest GST rates, and even after the 2% increment, it will remain below the average GST rates amongst major countries.

The below chart shows the GST/VAT rates in major economies of the world compared to the revised GST rate in Singapore.

With over two years living with the Covid-19 pandemic, every country in the world has taken a financial hit, depleting its reserves. Singapore, too, took the punch and to help them continue providing for their people, they see the need to increase the GST even more than ever. In 2021, GST contributed to 21% of the total tax revenue collected by the Government. The additional revenue generated through this would help them invest in Singapore’s social infrastructure as well as the growing healthcare needs.

But before we move on to the impact of GST increase on the businesses, let’s deep dive into what exactly is GST and who needs to pay it.

What is GST?

Goods and services tax is an indirect tax levied on all goods and services consumed within Singapore, including imports. It is charged at different stages of production and distribution of goods and services. It is also known as Value-Added Tax or VAT in other countries.

Not all companies can charge GST on goods and services offered. Only GST-registered companies can collect the amount and pay it to the government quarterly via GST tax filing. Based on the company’s requirements and the criteria set by IRAS, the company needs to register for GST.

All companies that meet the below conditions have to apply to IRAS to become a GST registered company:

- Taxable turnover exceeds $1 million at the end of the calendar year

- Taxable turnover is expected to be more than $1 million in the next 12 months

- Your business procures services from overseas suppliers, and it is not entitled to full input tax credit even if it is GST-registered.

- You are an overseas supplier or a local/ overseas electronic marketplace operator that provides digital services to individuals and businesses in Singapore that are not registered for GST.

In case a company doesn’t meet these conditions, it can still voluntarily register for GST to enjoy the benefits they offer. The most significant advantage is that you can claim your input tax provided you meet all the conditions for the same.

There are two types of GST:

- Output GST – These taxes are charged by the GST-registered business on all the goods and services supplied by them locally. This is paid by the end consumer and collected by the company on behalf of the government.

- Input GST – The GST-registered business pays these taxes on the goods and services they purchase for business purposes.

The net GST payable by the GST-registered business is calculated by deducting the input tax from the output tax in the given period. If there is any surplus, the amount is refunded to the business.

Impact of GST Increase on Businesses

Now that you understand GST better let’s look at its impact once it is increased.

Less Consumer Spending

With the increase in GST, the overall price of the products and services would increase. This would indeed have a negative impact on consumer spending, especially when it comes to luxury goods. Individuals and businesses would be more conscious of their expenses as they would be spending more for the same amount of goods and services they got in the past.

Increase in Inflation

While the GST hike will increase inflation, it would be good for the country and businesses in the long run. Inflation is usually momentary and would get stable as the economy grows. Also, the hike’s impact is not felt as soon as it is implemented but much later. And with the help of the phased GST hikes and the government grants, the effect is likely to be neutralised in about a year.

The revenue collected through the taxes enables the government to put it in the country’s development and grow its economy. Experts also believe that it’s better to increase the GST instead of income or corporate tax as everyone gets to keep as much as possible of what they earn and can choose to spend it only on what they need.

More cost pressure on Small and Medium Businesses

An increase in GST would further impact the bottom line of SMEs that are already dealing with the rising cost in the workforce, logistics and electricity. With the rise in these costs, they are already struggling to maintain the current prices of their good and services, and a further increase in the selling price would affect their consumer base.

Like for a restaurant business, where the sales have gone down by 25% due to the pandemic and safe distancing measures, the hike in GST along with an increase in the cost of their supplies, utilities, manpower, and rentals would significantly impact them. But, ultimately, the consumers will have to pay the price of this rise as it will trickle down to them, which in turn will bring down the sales.

More tax implications for Non-GST registered companies

While the GST registered companies would be able to claim the GST, non-GST registered companies would have to absorb the incremental rate themselves as they are not eligible for the input tax credit scheme. For example, small businesses that are not currently GST registered would feel the pinch of a 2% increase in the material cost or rental more than others. They will have to take a call if they would be able to absorb the cost increase or pass the incremental cost to the consumer by raising their selling price. Or maybe consider voluntarily registering for GST.

Also, some GST registered companies in specific sectors that cannot fully claim their GST would have a direct hit on their bottom line. These companies include the ones that deal in exempt supplies like the banks, stockbrokers, insurance companies, and residential property dealers. But they can take advantage of industry-specific GST schemes, if any, to alleviate these charges.

Increase in Digital Tax

GST would also increase on the digital services and would impact the individual consumers and non-GST registered businesses using imported services. The GST-registered companies would be able to claim this expense under the reverse charge regime. But, with e-commerce on the rise, the digital tax would help the government increase its revenue pipeline.

Companies might need to absorb part of the tax

Companies that provide goods and services with a high price elasticity of demand might have to consider absorbing a part of the taxes to cater to the increased price. This would ensure that the consumers who are highly sensitive to price change don’t look for cheaper alternatives and keep coming back to them. After all, desperate times call for desperate measures. This would increase the cost to the company but ensure they remain in business.

Government Support Schemes

The Government has the following GST support schemes in place to give some relief to businesses and help them maintain their cash flow.

Cash Accounting Scheme:

This scheme helps to ease cash flow as well as compliance for small businesses who have voluntarily registered for GST. The companies need to account for the output tax only once they have received the payment, unlike under usual circumstances.

Import GST Deferment Scheme (IGDS):

GST-registered business under this scheme can defer their import GST payment and pay it at the end of the month while filing their GST returns rather than at the time of importation. This allows the importers to enjoy a credit period of one to two months, similar to buying from local sellers (30-day term credit).

Major Exporter Scheme (MES):

MES is for enterprises that import and export goods significantly. Under this scheme, they need not pay GST on non-duty imports and also when the goods are removed from a Zero GST warehouse.

Discounted Sale Price Scheme:

When a company sells second-hand or used vehicles, it can charge GST only on 50% of the sale value under this scheme.

Gross Margin Scheme (GMS):

GMS enables businesses that sell second-hand goods to charge GST (output tax) on the gross margin instead of the total value of the goods. Gross margin is the difference between the selling price and purchase price of the goods. In such cases, the buyer of the used goods cannot claim any input tax even if they are GST registered.

Hand-carried Exports Scheme (HCES):

This scheme allows exporters to hand-carry the goods out of Singapore via Changi International Airport. They need to have a valid export permit (OUT Permit or Cargo Clearance Permit) via TradeNet for the same. They can then refund the GST to their overseas customer and report the sale as a zero-rated supply.

Zero GST (ZG) Warehouse Scheme:

Singapore Customs has certain approved warehouses where businesses can store imported non-dutiable goods. They need to pay GST on these goods once they are removed from the ZG warehouses.

Tourist Refind Scheme (TRS):

Tourists can claim a GST refund on the goods purchased in Singapore before they leave. GST-registered businesses can choose to operate this scheme as an Independent Retailer or engage the services of a Central Refund Agency.

Apart from these general schemes, they also have industry-specific GST schemes for industries like marine, logistics, contract manufacturers, and traders.

A GST hike majorly hits the consumers. So, to mitigate the impact of the hike, the government had earlier announced to keep aside S$6 billion for the Assurance Package to support the lower-income householders over the next ten years. They would permanently enhance the GST Voucher scheme to provide more support to lower-income families. Other schemes like Grocery Vouchers, Public Transport Vouchers and S&CC rebates would also help cover up the impact of the GST hike. The government will also continue to absorb the GST on publicly-subsidised healthcare and education.

All these measures would ensure that the spending power of lower-income, middle-income, and retirees doesn’t decrease drastically and can continue to buy the essential goods and services for their households. Moreover, this would indirectly guarantee less impact on the businesses.

How to Register Your Business for GST?

Make the most of the grants and schemes provided by the Government by registering your company for Goods and Services Tax. In addition, as a GST-registered company, you won’t have to bear the brunt of GST increment and can claim your input tax. The registration process is simple, and we at Timcole can make it even simpler for you. We can also help you file your GST every quarter and avoid penalties for late or inaccurate filing.

The registration process depends on your company structure and the type of GST registration. You can submit your application via the myTax portal along with all the supporting documents. However, if you are applying for the GST voluntarily, you would have to first complete the e-learning course on “Overview of GST”. Its also manadority to sign up for GIRO for your GST payments and refunds while applying.

After the application is processed and is successful, which usually takes ten days, you will receive a letter at your registered address. The letter will contain your company’s GST registration number and the effective date of registration.

Registeration for Overseas Businesses

If you are an overseas business importing goods for supply in Singapore, you need to register for GST if your taxable supplies in Singapore exceed the $1 million. You can also voluntarily opt to register for GST. As an overseas entity, you also need to appoint a local agent to manage your accounting and payment of GST. Instead, you can also engage a GST-registered Singapore agent to import and supply goods in its name and claim the GST paid on imports. This way, you don’t need to register for GST.

Overseas suppliers and electronic market operators can register for GST under the overseas vendor registration regime. However, while they don’t need to appoint a local agent, they need to give a security deposit if they are registering for GST voluntarily.

If your company dynamics have changed or are likely to change due to the increase in the GST rates, don’t hesitate to connect with us to discuss your concerns. As committed advisors to our clients, we would be happy to provide you with the best solution and also help you register for GST if required.